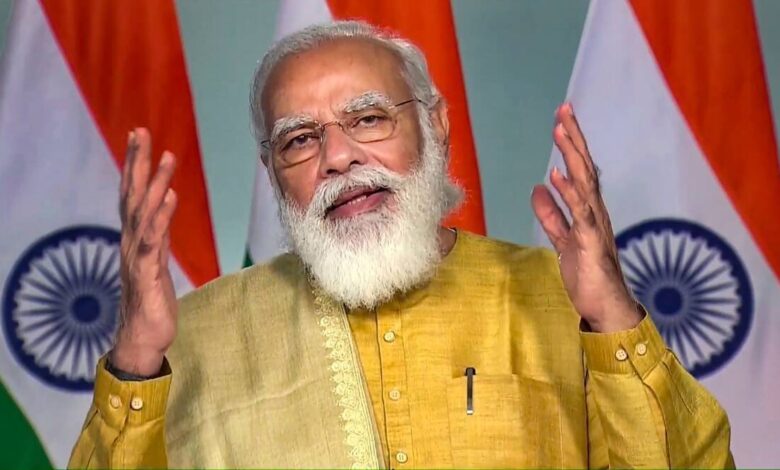

PM Modi on the Centre-State partnership during Covid

Synopsis: On Tuesday, PM Modi said that the Centre-State partnership helped the states raise an extra Rs. 1.06 Lakh Crore in 2020-21. It introduced four key reforms.

The Centre-State partnership or “bhagidari”aided four key reforms:

- First, one nation-one ration card scheme.

- Second, online and automatic renewal of business-related licenses. Covered under seven Acts through mere payment of fees.

- Third, notifying taxes by states. It will include property tax, water, and sewerage charges.

- Fourth, direct benefit transfer.

PM Modi focused that the innovative approach will aim at improving the ease of living of the poor, the weaker sections, and the middle class.

PM Modi took to LinkedIn and posted a blog. The blog was titled “Reforms by conviction and incentives”. Notably, through additional borrowing, the states were able to raise the funds.

Owing to the global pandemic, the world is facing a financial crisis.

During this time the states were able to raise Rs. 1.06 Lakh crore in 2020-21. This was possible because of the Centre-State partnership (bhagidari).

India has a federal policy. So, a one size fits all model will not be applicable. Hence, the Centre should not look for policies that will promote reforms in the states. The Centre stands by its faith in the robustness of the federal structure.

In May 2020, the Centre announced enhanced borrowing by the states for 2020-21. Implemented as a part of the Aatmanirbhar Bharat Package. 2% of extra GSDP was also allowed.

The four key reforms were supported by the additional borrowing. Around 0.25% of the GDP was tied to each reform. The reforms will also promote financial sustainability.

Let’s discuss the four reforms in detail:

In the first reform, the one nation-one ration scheme. All the ration cards under NFSA are to be seeded with the Aadhar Card number of all the family numbers. Also, all the fair price shops are to be equipped with ePoS devices. This will ensure that the migrant workers will be able to get ration anywhere in the country. Also, duplicate cards and bogus entries will be eliminated. To date, 17 states have implemented this reform. So, they have been granted additional borrowing of Rs. 37,600 Cr.

The second reform has the renewal of business-related licenses. Also, it will ensure online, automatic, and non-discretionary payment of fees.

As a part of the third reform, states need to update and notify on the taxation. It will include floor rates of property tax, water and sewerage charges, values for a property transaction in urban areas.

11 states have implemented the reforms. So an additional borrowing of Rs. 15,957 crore was guaranteed to these states.

The last reform was the implementation of Direct Benefit Transfer (DBT). It will provide free electricity to farmers. Around, 13 states have implemented one of the components. While 6 states have already implemented the DBT component. It has resulted, an additional borrowing of Rs. 13,201 Cr.

To sum up, 23 states availed an additional borrowing of Rs. 1.06 crore. However, the potential sum that could be borrowed was Rs. 2.14 crore. Which stands around 4.5% of the initial estimated GSDP. Also, it is inclusive of conditional and unconditional borrowing.

Do read other article: Tokyo Olympic Village: Facilities To Look Forward To, Rules To Follow

One Comment