How does the National Monetisation Pipeline scheme work?

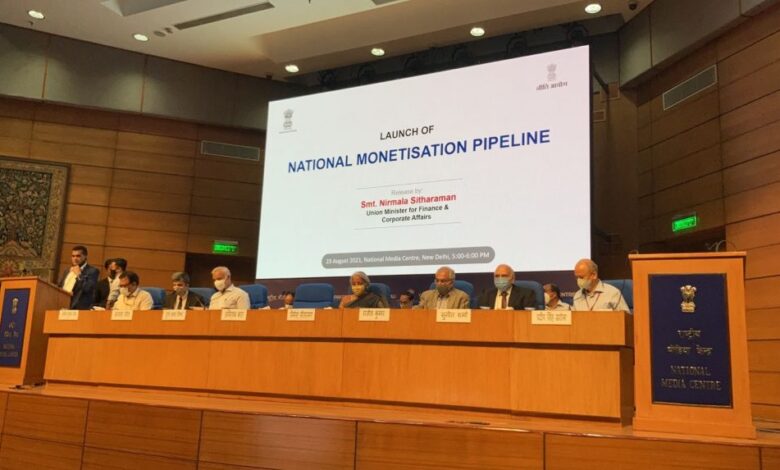

FM Nirmala Sitharaman recently launched the National Monetisation Pipeline scheme of central ministries and the public sector.

NITI Aayog, India’s think tank developed the scheme in consultation with infrastructure line ministers. It is based on the mandate for ‘Asset Monetisation’ under the Union Budget for the financial year 2021-22. The National Monetisation Pipeline (NMP) scheme estimates an aggregate potential value of Rs 6 lakh crores from core assets of the Central Government. Notably, the timeframe for NMP is over four years from the financial year 2022-25.

Invest in infrastructure will be an enabler for growth:

Investment in assets is a driving factor for the accelerated and socio-economic development of any country. Why? it will result in bridging the gap in the infrastructure. Estimating an infrastructure investment of Rs. 111 lakh crore over five years (2020-2025).

Especially for a country like India, financing investments in infrastructure requires a diversified set of options and alternatives. Also, there is a need to look beyond the traditional sources or financial models.

Thus, NIP has emphasized innovative mechanisms such as asset monetization. Hence, the scheme will generate additional economy.

The Concept of Asset Monetisation

The Asset Monetisation Policy, also known as capital recycling. This consists of the limited period transfer of assets.

But why? Because it will result in unlocking the idle capital and reinvesting it in other assets for additional benefits.

Governments and public sectors which own and operate such assets are mainly responsible for providing infrastructure services. Why this concept? It will aid to meet the demand of the increasing population.

Why? Because it will result in improved quality of public assets and services.

The asset monetization plan is majorly classified into three approaches:

- First, Direct Contractual Approach like PPP concessions

- Second, Structural Financing Models

- Last, To illustrate, Infrastructure Investment Trust and Real Estate Investment Trust.

What is the need for NMP?

Moreover, for NMP to progress in the right direction, the availability of a structured pipeline is necessary. Furthermore, sustained flow of transactions and visibility on the same is a pre-requirement. Also, a robust monetization pipeline enables fundraising. Helping asset owners track and scan the performance of the assets.

With this thought, the National Monetisation Pipeline (NMP) scheme was launched in the Union Budget of 2021-22.

Also, the NMP will aid in forming a common framework for the monetization of core assets. Moreover, the plan will critically clarify its distinction from the concept of privatization. Thus, it will enable in creating a virtuous cycle of development, commission, monetize and investment.

The three main imperatives of monetization of core assets framework are:

- First of all, the NMP will remain co-terminus for the remaining four-year period of NIP.

- Second of all, NMP will form a baseline for monitoring and tracking. Which will include the investments, the performance of the assets. Notably, for for a period of four years from 2022-25.

- Third of all, NMP report is structured in two Volumes (I and II).

Volume I: Guidance Book for Asset Monetization

Volume II: Medium-term roadmap having the pipeline of assets of Central Government. And, it has CPSEs in infrastructure sectors with high monetization potentials.

What is the summary of the National Monetization Pipeline (NMP)?

Summing up the total value of the NMP scheme for core assets of the Government is around Rs 6 lakh crore. And, the said period is four years, for the financial year 2022-25.

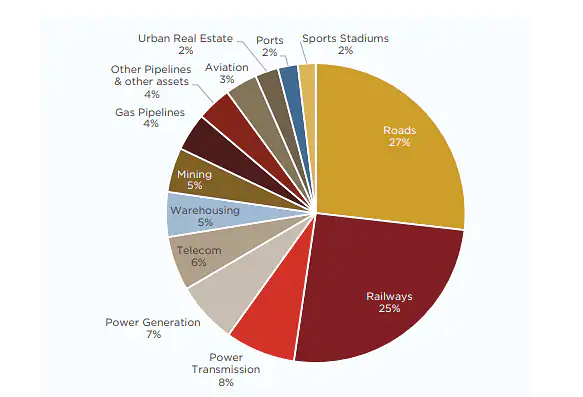

Given below is the breakup of the pipeline scheme and the sectorial share is:

By annual phasing, 15% of the assets with an estimated value of Rs 0.88 lakh crore. And, this amount is to be rolled out in the current financial year.

Interestingly, the top 3 sectors, as estimated by the value are Roads (27% share). Then comes railways (23% share) and power (15% share).

What is the approach to NMP?

Notably, the NMP is an aggregate of information from various sources. Some of the sources include line ministers, departments, and assessments of secondary information on existing assets.

Noticeably, the monetization value only indicates high-level estimation. The estimation is generally based on the thumb rule.

The actual value will be determined by detailed evaluation or feasibility studies during transaction structuring.

Also, Check out other articles: Vaccination In India Cross 75 Crore Doses: 43% Coverage By December

Is Bhupendra Patel’s appointment as CM of Gujarat a masterstroke?